When renting an apartment is not always about budgeting and the area. You need to know your credit score also known as the FICO score. This is a simple way a landlord will know if you are creditworthy or a risk-based on your previous financial history.

Why is it so important for a landlord to know your credit score if it’s only an apartment? Because it details your history of paying off debt on time and the landlord will use this to see how likely you will pay your rent on time. That means in the landlord’s eyes those 3 digits will determine if you will get approved or not, according to the Local Records Office.

How is My Credit Score Calculated?

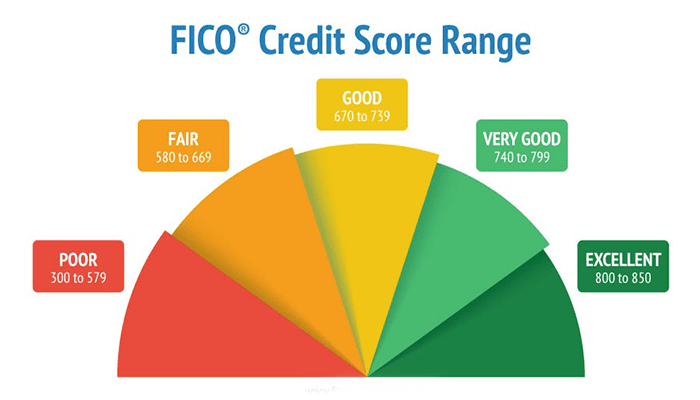

A credit score is broken down into three categories; poor, fair, and excellent. These three categories will determine if you will get approved for a credit card, home loan, and even a car loan. Credit scores range from 300 (poor credit) to 850 (excellent credit).

A credit score of 300 to 579 is usually poor. 580 to 669 is fair, 670 to 739 is good, 740 to 799 is very good and 800 and up is considered excellent starting 2020.

Comments

Post a Comment